- #Where can i get a copy of my 2016 tax extension how to#

- #Where can i get a copy of my 2016 tax extension verification#

- #Where can i get a copy of my 2016 tax extension software#

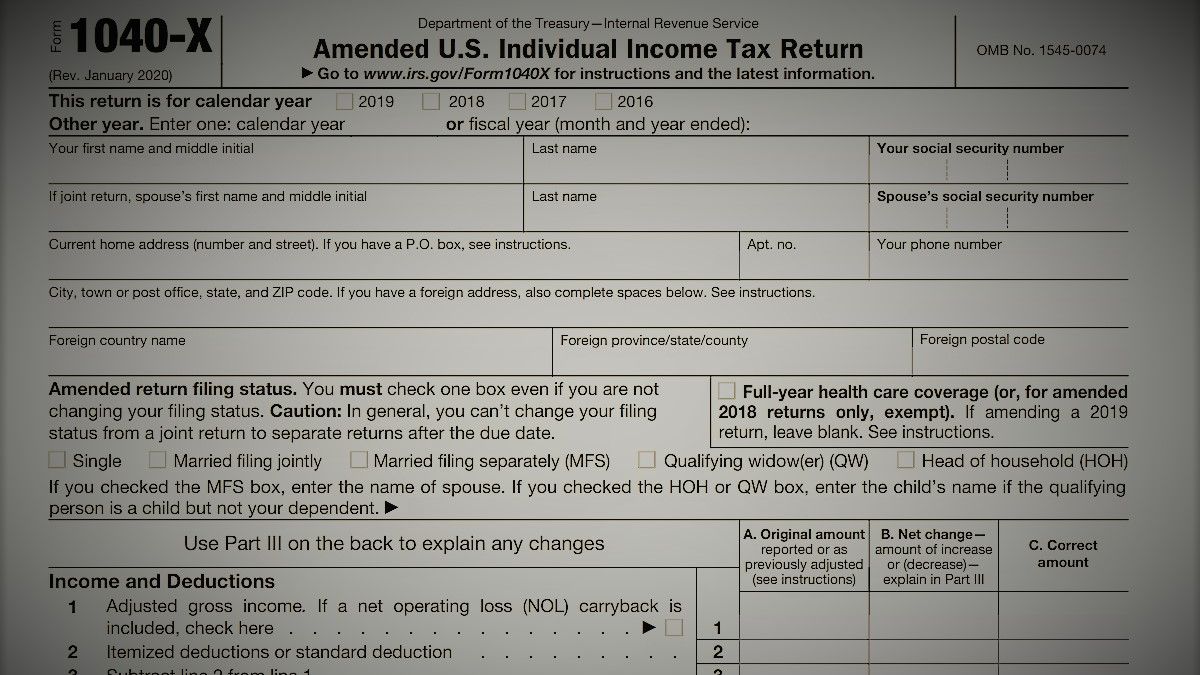

Note: To amend a return for tax years prior to 2017, you must complete and mail a paper return. See How to change or amend a filed return. If you find an error after we accepted your e-filed return, submit an amended return using your software. When you file an extension, your tax return process might be a bit more complicated than most. 15 in order to make the tax filing extension deadline. The mailbox rule requires that your return is postmarked and sent by Oct. If we find an error and reject your e-filed return, correct the error that caused the rejection and resubmit your return. The exact due date for tax filing extensions for tax year 2021 is Oct. Submit your payment with a completed Form IT-201-V, Payment Voucher for Income Tax Returns.Ĭorrecting a mistake on an e-filed return.Note: the card service provider charges a convenience fee of 2.25% for each card payment you make.See Credit and debit card payment information (en Español) to learn how.by most major credit or debit cards through Online Services.directly on our website through your Individual Online Services account.on your e-filed tax return-you can schedule your payment for any date up to and including the due date or.If you would like to make an income tax return payment, you can pay:

You may also choose to receive your refund as a check when you e-file your return. It's the fastest way to get your tax refund. To avoid delays, provide us with, and confirm, your bank account and routing numbers on your e-filed return. You can receive your refund up to twice as fast when you choose direct deposit as your refund method.

#Where can i get a copy of my 2016 tax extension verification#

You will need this information for verification purposes if you need to contact us. Keep a copy of your completed return with your other tax documents (for example, Forms W-2, W-2G, 1099-DIV, 1099-INT, and 1099-R). You can resubmit the corrected return electronically. See Correcting a mistake on an e-filed return for more information.Ĭopy of your e-filed New York State tax returnĭo not mail a copy of your return to the Tax Department.

#Where can i get a copy of my 2016 tax extension software#

If your return has an error and is not accepted, your software company will notify you and identify the error so you can fix it. Your filing software will issue confirmation that the New York State Tax Department received and accepted your return.Ī small percentage of e-filed returns have errors. Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals.Īcknowledgment that the department received your return.Form IT-2105, Estimated Tax Payment Voucher for Individuals and.resident, nonresident, part-year resident, and amended returns.If you earned $69,000 or less last year, you can Free File using brand name software accessed through our website. If you earned more, you can purchase approved commercial software or use a paid tax preparer to e-file your return.Īll personal income tax forms can be e-filed, including: Most New York State taxpayers can e-file their returns. Request an installment payment agreement.Metropolitan commuter transportation mobility tax.

0 kommentar(er)

0 kommentar(er)